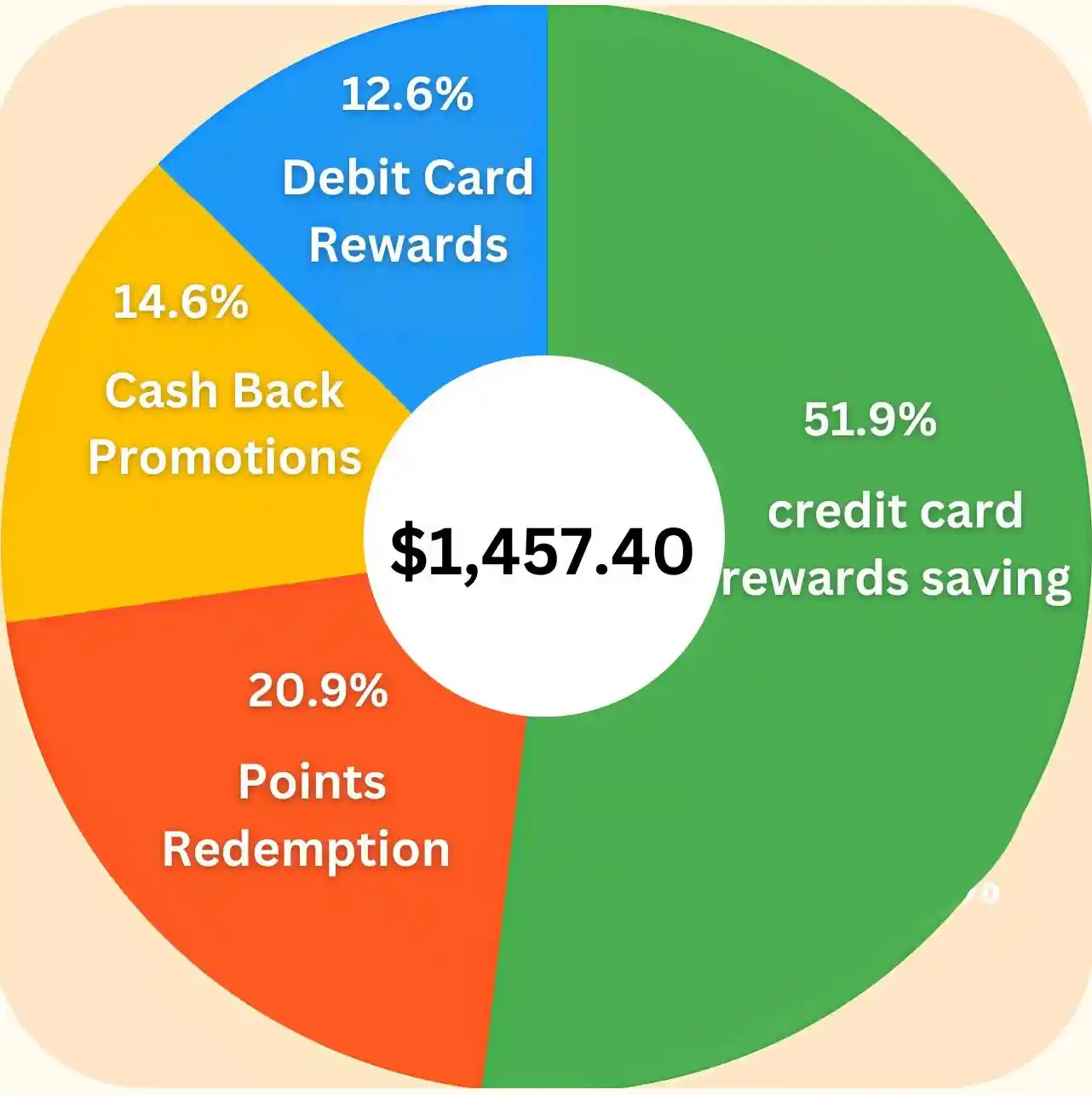

Below is a comprehensive analysis of the potential annual savings that can be achieved through credit and debit card rewards, cash-back programs and loyalty points for the average consumer. These rankings result from a thorough evaluation of historical and current return trends, reward structures and promotional offers. The analysis also includes a detailed comparison of various credit and debit cards and an overview of current transactions on platforms such as e-commerce and other platforms.

Savings on Credit Card Rewards

Credit card rewards typically include cash back, points, and miles. The average consumer spends about $61,000 per year (2023 data from the Bureau of Labor Statistics), a significant share across compensation categories.

Assumptions

- 40% of the total spend cost on your credit card.

- Premium Price:

- 1-2% on total purchase.

- 3-5% on purchases from certain categories like food, grocery or travel.

Calculation

- Typical purchase cost: $24,400 × 1.5% (average rate) = $366 per year

- Bonus category expenses (40% of credit card spend): $9760 × 4% (average rate) = $390.4 per year

Total credit card savings: $756.4 per year.

Save on Debit Card Benefits

Debit cards offer fewer rewards than credit cards. Let’s assume the spend bonus is between 0.5% and 1%:

- 40% of the total spend cost on your debit card.

- Debit card fees: $24,400 × 0.75% (average rate) = $183 per year

Cashback Offers & Promotions

Many cards and apps offer extra cash back on purchases at certain stores or during promotional periods.

- We get average 1.5% cashback without using credit card and debit card with spending 20% of total spend

- Estimated annual savings from cashback promotions: $183-$244/year

Average: $213 per year.

Point Redemption Amount

For credit cards that offer points instead of cashback, the average redemption rate is 1.25 cents per point. At an average rate of 2% cashback on eligible spend:

- Total points: $12,200 × 2% = 244 points.

- Value of redeemed points: 244 x 1.25 cents = $305 per year

Total Annual Savings

Add all categories:

- Credit Card Rewards: $756.4.

- Debit Card Rewards: $183.

- Cash Back Promotions: $213.00.

- Points Redemption: $305.

Estimated Total Annual Savings: $1457.4

Percentage of annual income saved

The median household income in the U.S. is approximately $61,000/year. The percentage saved through rewards is:

Breakdown by Cost Category (Example)

| Category | Annual Cost | Premium Price | Savings |

|---|---|---|---|

| food | $7,000 | 4% | $280 |

| food | $3500 | 3% | $105 |

| travel | $5000 | 5% | $250 |

| Gas/Transport | $3500 | 3% | $105 |

| General Purchase | $42,000 | 1.70% | $717.4 |

Important information For customers

- Increase your spending. Using credit cards with higher rewards rates in certain categories allows you to maximize your savings.

- Avoid Interest Payments: Always pay the balance in full to avoid losing rewards due to interest payments.

- Combine the sentences. Use in-store discounts, promotions, and apps like Rakuten or Ibotta to earn rewards.

- Annual Savings Potential. With proper planning, consumers can save 2-5% on their annual spending through cash back and rewards programs.

This analysis shows that by using rewards and cashback effectively, consumers can save a significant portion of their income each year.

Card Rewards & Payment

- A Detailed Guide to the Ultra Beauty Rewards Card: Benefits, Benefits and How It Works

- How to maximize Ulta points and How to Redeem Ulta birthday gift online

- sunrise bank prepaid card :Understanding Prepaid Debit Cards: Uses, Benefits, and Fees

- How I Purchased a Canon M50 with PC Points

- Optimum Rewards Card : Introduction to the PC Plus Points Card

- Hilton Points Calculator : Understanding the Value of Hilton Points

- Michaels Credit Card : Introduction to Michael’s New Credit Card

- Dynamix Medical Charge On Credit Card : Understanding and Solutions

- credit card generator from my card : How to Get a Real Working Credit Card Generator with Money

- 405 Howard Street San Francisco Charge On Credit Card

- Transform Your Beauty Budget: Ulta Credit Card Limits Now Up to $10,000

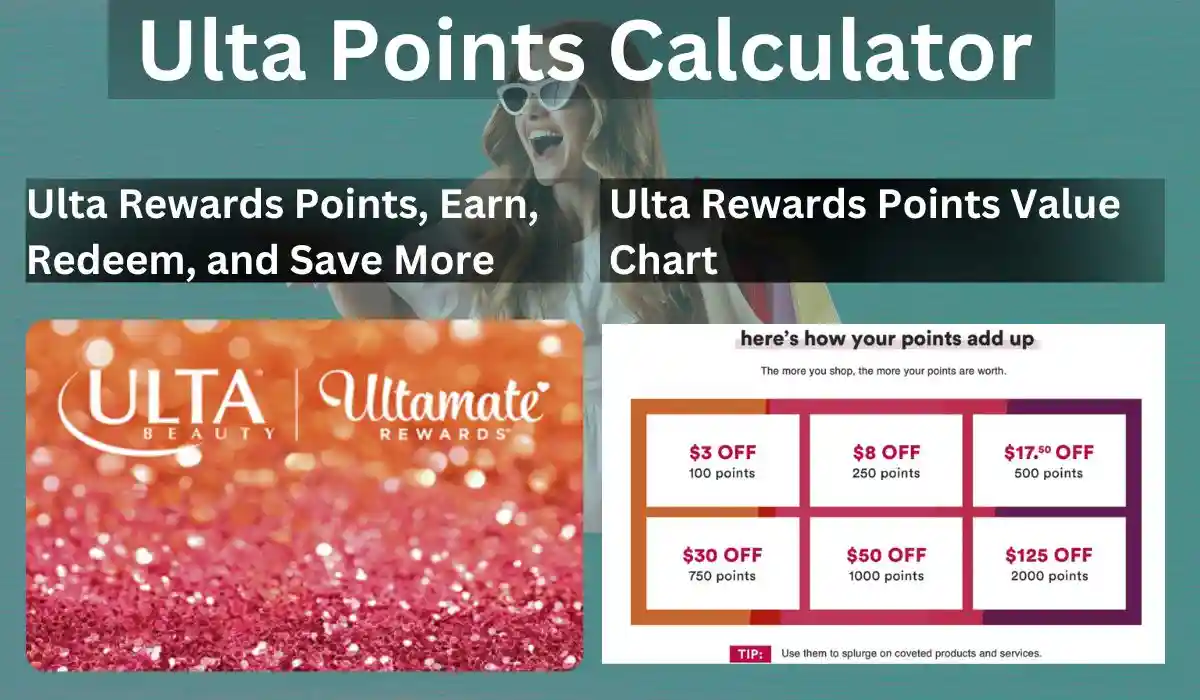

- Ulta Points Calculator: Ulta Rewards Points, Earn, Redeem, and Save More

- Ulta Credit Card Login : How to Log into Your Ulta Credit Card Pay Account

- Ultamate Rewards Mastercard Payment : A Step-by-Step Guide

- Why the Ultamate Rewards Mastercard is a Must-Have for Ulta Shoppers

Credit Card

- Best Metal Credit Cards of 2024: Travel Rewards, Luxury, and Durability

- Guide to CheapOair Credit Cards: Features, Rewards and Application Process

- TJMaxx Credit Card Payment Synchrony: complate information about TJMaxx credit card

- TJX Rewards Credit Card: Everything You Need to Know

- Maximize Savings with the TJMaxx Credit Card: Features, Rewards, and Tips

- How to Request a Refund for Certus Airvac Charges: A Step-by-Step Guide

- Understanding Certus Airvac service charge on Your Credit Card: Understanding Tire Inflation Service Fees and How to Track Small Expenses

- How to Apply for SBI Cashback Credit Card | Benefits, Process, & Detailed Review

- Comparative Study of Axis Cashback Credit Card and Cashback SBI Card

- How to Apply for a Yes Bank Credit Card Without Income Proof: A Step-by-Step Guide

- Unlock Exclusive Perks with the Macy’s American Express Credit Card

- How to Choose the Best Credit Card for Cashback and Discounts in the US

- Applying for A Bank’s Credit Card, Benifits, Eligibilty and Application Process

- Understanding mmbill charge on credit card, all details about mmbill charge

- What is Certus Airvac Service Credit Card Charge and certus air vending charge on credit card

- Introduction to the Wawa Credit Card: Benefits and Application Process

- Introduction to the Credit Card Authorization Form

- Michaels Credit Card : Introduction to Michael’s New Credit Card

- The Magic Behind Contactless Payments: NFC Technology

- Dynamix Medical Charge On Credit Card : Understanding and Solutions

- credit card generator from my card : How to Get a Real Working Credit Card Generator with Money

- 405 Howard Street San Francisco Charge On Credit Card

- fd150 credit card terminal manual pdf : Unboxing and Operating the FD150 Terminal

- Does Toyota Accept Credit Card Down Payment : Understanding Car Pricing and Dealer Fees

- Understanding the New auto pass credit card Rules

- Decoding Evolution Technology Charge On Credit Card

- Managing Transactions with a Multi Merchant Credit Card Terminal

- Maximizing Benefits: The Wayfair Mastercard Upgrade Explained

Card Payment

- How to use Dasher Direct Virtual Card for Business

- How do I get my doordash balance onto the dasher direct card?

- Automated Bill Reminders: How They Simplify Financial Management

- How to Pay Ulta Credit Card| A Complete Guide to Paying Your Ulta Credit Card

- How to Set Up E-Billing for Your Business

- Electronic Invoicing Benefits: Why Businesses Are Changing

- Understanding E-Billing Care Charges: What They Are and How They Affect Your Bills

- Ensuring Secure Digital Payments: Key Tips for Businesses in the Post-Pandemic Era

- What Is P2 Truedly Transaction Mean on Your Bank Statement?

- How to Transfer Money from a Linked Bank to Cash App and A Complete Guide to Cash App for Beginners

- Cars For 500 Down Payment: The Best Vehicles You Can Buy for Just $500

- How I Purchased a Canon M50 with PC Points

- The Magic Behind Contactless Payments: NFC Technology

Debit card

- How to Get Money Off the DasherDirect Virtual Card

- How do I get my doordash balance onto the dasher direct card?

- DasherDirect Card: A comprehensive financial solution for DoorDash drivers

- Benefits Of Debit Cards: Why Choose a Chase Debit Card? All the Benefits You Need to Know

- what gift card can i use at atm? Everything You Need to Know

- Visa Prepaid Card Activation : How To Order, Activate, SetUp, Use and Manage Visa Prepaid Card

- can you use ulta points online

- Capital One

- certus airvac service charge

- Certus airvac service charge increase

- Certus airvac service refund phone number usa

- Certus Airvac service charge

- Chase Sapphire Reserve

- CheapOair Credit Card

- Comenity Ultamate Rewards Mastercard

- Contactless Payment

- Credit Card Authorization Form

- credit card generator from my card

- DasherDirect Card

- Dasher direct Visa card

- Digital invoice management

- Does Toyota Accept Credit Card Down Payment

- do ulta points expire

- Do Ulta Rewards Points expire?

- Dynamix Medical Charge On Credit Card

- E-Billing Care Charges

- E-Billing Issues

- E-invoicing convenience

- E billing payment

- Electronic Invoice Payment

- Electronic Invoicing Benefits

- embark credit card

- Evolution Technology Charge On Credit Card

- FD150 Credit Card Terminal Manual pdf

- hilton points calculator

- How do I get my doordash balance onto the dasher direct card?

- How Do You Redeem Your Ulta Rewards Points

- How to Activate Your Ulta Credit Card

- How to Add a Payment Method on Ulta Beauty

- How to Apply for a Yes Bank Credit Card

- How to Apply for SBI Cashback Credit Card

- How to Apply for Ultra Beauty Rewards Card

- How to avoid evolution technology charge on debit card chase

- How to Get Money Off the DasherDirect Virtual Card

- How to Pay Ulta Credit Card

- How to Redeem Your Ulta Points Online

- How to Set Up Automatic Payments

- How to Sign Up for an Ulta Beauty Account

- How to Pay Evolution Technology Fees with a Chase Debit Card

- How to use Dasher Direct Virtual Card for Business

- Important Tips for Using Your Credit Card Wisely

- JP Morgan Reserve Card

- Macy’s American Express Credit Card

- memivi credit card

- michaels credit card

- multi merchant credit card terminal

- Optimum Rewards Card

- Paperless bill payment process

- Platinum Card from American Express

- Platinum MasterCard

- Set up e-billing

- Set Up Electronic Bill Payment

- TJMaxx Credit Card

- TJMaxx credit card account

- TJ Maxx Credit Card Account

- TJMaxx credit card login

- TJMaxx credit card online

- TJ Maxx Credit Card payment

- TJMaxx credit card payments

- TJMaxx Credit Card Payment Synchrony

- TJ Maxx Credit Card rewards

- TJX Credit Card

- TJX MasterCard

- TJX Rewards

- TJX Rewards Credit Card

- tjx rewards mastercard

- TJX Rewards Mastercard Platinum Card

- Ulta Beauty credit card payment

- Ulta Beauty Rewards credit card

- Ulta Card

- Ulta Credit Card Limit

- Ulta Credit Card Login

- Ulta credit card payment

- Ulta Mastercard

- Ultamate Rewards Mastercard

- Ultamate Rewards Mastercard Payment

- Ulta pay my bill

- Ulta Points Calculator

- Ultra Beauty Rewards Card

- Ultra Beauty Rewards Card Benefits

- Wawa Credit Card

- Wayfair Mastercard Upgrade

- What Is DasherDirect App

- wireless credit card chip tech crossword